Contents:

The asset is up by almost 9% while the global volume has fallen by 14% in the last 24 hours. Long Legged Doji Candlestick PatternWhenever you see the open price equal to the close price. Not only this, the upper shadow should appear equal to the lower shadow.

A tweezer bottom is a bullish candlestick pattern that is formed at the end of a downtrend in the market. It is formed when the sellers are not able to push the prices down any further in the market. Doji candlestick can help traders, and even investors, to a large extent, can help identify trend reversal points on chart patterns. At the top of the bullish trend, that was created with the bullish tristar pattern, we find another pattern which is a bearish tristar.

- The hanging man pattern looks the same as the Hammer pattern, but bullish trends are shown by the Hanging man pattern.

- We looked at 5 of the more in style candlestick chart patterns that signal shopping for opportunities.

- Analysts said normally such candle formations after a reasonable rise signals volatility at the highs and sometimes acts as a reversal pattern post confirmation.

- By comparability, technical analysts consider actions in worth.

- Gravestone Doji – Gravestone Doji lies on the other side of the spectrum of Dragonfly Doji.

- This article explores the Doji candlestick pattern and its variations – Gravestone and Dragonfly – which are used in technical analysis to predict market trends and price reversals.

Fundamental evaluation helps analysts choose which shares to trade, while technical evaluation tells them when to commerce it. The candlestick chart is one of many tools for technical analysis. By understanding these differences, technical analysts can shortly glean a lot of data from the color of a candlestick before taking a look at any elements of the chart.

Importance of Doji

Long Legged Doji Candlestick FormationIn this chart, after the pullback, a long-legged Doji indicated the bottom of the pullback, and the market then carried on with its trend. Thursday’s market movement would depend on the stance taken by US Fed Chair Jerome Powell and how the US markets react to it. One can begin to analyse the various patterns and different shapes, lengths, and colours as each pattern mean something, as explained above. Whether it is increasing or decreasing over time, this will give a rough idea of how long it takes for a peak-to-low to occur and how considerable the price changes will be. The above diagram shows that the stock rises and falls, but each time successive peaks and lows are higher than the last.

The price range is calculated by subtracting the lower price from the higher price. This family consists of related single candlestick patterns. Hammer candlestick patterns have a long lower or upper wick and a small body on the opposite side. A candlestick chart shows that emotion by picturising the size of the price moves using different colours. By regularly analysing the candlestick chart, an investor can make a trading decision based on the regular occurring patterns of directions of the price.

The opening and closing values are the same, with different high and low. A long-legged Doji, with long upper and lower shadows, is called a “Rickshaw Man”. It is a reversal candlestick pattern that may appear in either an uptrend or a downtrend. The first candlestick is a protracted down candle which signifies that the sellers are in control.

Candlestick Reversal Patterns

The third candle will be a large green candle that opened above the second candle. This pattern is formed when there is a large red candle followed by a small green candle inside the previous red candle. An inverted hammer is a candle formation that occurs at the bottom of the downtrend. This candle pattern has a small body and a wick only at the top which is as twice the size of the body. So traders have to combine the support and resistance as well as other indicators to confirm the probability of a trend reversal indication from the formation of Doji.

When the close worth and the high value are the same or very close, the candlestick could have no or little real physique. This candlestick indicates extreme indecision since all four of its components remain at the same level. ⭐When a Doji candlestick appears, pay special attention to the candlestick’s prior price activity. If two identical Doji candlesticks develop consecutively, a high probability setup can be formed . Standard Doji Candlestick FormationThe above chart shows a price reversal movement after the formation of a typical Doji at the bottom. Price Data sourced from NSE feed, price updates are near real-time, unless indicated.

Shooting Star: What It Means in Stock Trading, With an Example – Investopedia

Shooting Star: What It Means in Stock Trading, With an Example.

Posted: Sat, 25 Mar 2017 19:31:54 GMT [source]

The Doji is a single candlestick pattern that indicates weakness and a potential trend reversal. This can be either a bullish or a bearish trend reversal, depending on where the doji appears on the price chart. A doji is usually a relatively short candlestick with no real body, or very little real body. Looking closely at the candlestick chart above, we find that the bullish tristar pattern is marked in a black circle. The middle Doji forms the lowermost price point of the pattern. Due to price reversal, the middle Doji is where the bearish and bullish trends meet.

The double doji candle above shows us that the bullish pattern ends with the middle Doji, as the price reaches the highest point in this candle. From the third candle, the bearish price reversal commences. Doji Star – It looks like a star with the same opening and closing values, and equal length upper and lower wicks. It appears when neither bullish nor bearish trend is significant enough to sway market sentiment.

Exponential Moving Average (EMA): Complete Beginner’s Guide with Trading Strategy

The strength and momentum for both seems to be at par, resulting in the price settling at the equal level. The Dragonfly Doji, long-legged Doji, Gravestone Doji, star Doji, and hammer Doji are some of the types of Doji in stock market. Both patterns want volume and the next candle for confirmation. It is probably extra helpful to think about both patterns as visual representations of uncertainty quite than pure bearish or bullish signals.

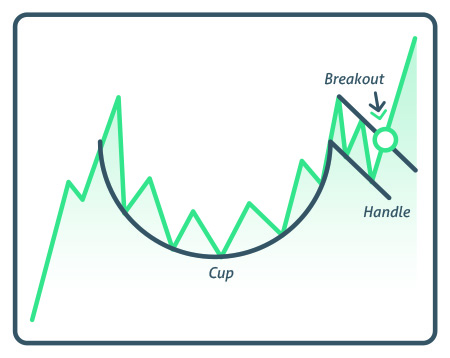

It is referring to the breaking of essential support or resistance level in the chart pattern, which can often be a mistake. When we look at the real examples, you will see how any trader can make a mistake of misreading it. An easy way to learn everything about stocks, investments, and trading. The most prevalent pattern is a bearish Gravestone Doji, which can appear near market tops. As the asset’s price continues to fall, the price chart for Natural Gas below indicates a Gravestone Doji in a downtrend. A pullback to the upside is followed by a tombstone, which signifies the end of the higher pullback.

Continued worries about the health of the US regional banks, which dragged Wall Street down on Thursday night, also contributed to declines. Double Doji can give more conviction in trading with even a more reliable trend reversal move that may unfold. However, in some cases, one can’t make a decision based on a single Doji candlestick. So then one can also find double Doji candlesticks one after the other. The best application of Doji candlestick is on the daily charts. Moreover, there are Doji candlesticks formed on the wrong side of things.

US Stocks Fell on The Fear of Recession, Snapchat Stock Price Also … – The Coin Republic

US Stocks Fell on The Fear of Recession, Snapchat Stock Price Also ….

Posted: Thu, 29 Dec 2022 08:00:00 GMT [source]

This is the image of a tri-star formation at the end of a long downtrend and signals the shift in market forces. This pattern consists of a long red candle followed by a Doji candle that is located in the middle of the previous candle. The body of the candle indicates the price at which a security has opened and closed during a specific time period. The wick or the shadow of the candle indicates the high and low security reached during a specific time period.

Open Demat Account &

A Doji pattern is said to be formed when on a certain trading day, the closing, as well as the opening price, are more or less at the same level. It looks like a plus (+) sign or a cross where the body of the candle is very small or nonexistent. The three inside down is a candlestick formation that is formed at the top of an uptrend. It is a bearish pattern that indicates the reversal of the uptrend in the market.

In the candlestick chart, each candlestick indicates the open, the close, the high, and the low for the time frame a trader has chosen. Candlestick charts also show the current prices as they are prepared. The attitude of the market participants is reflected by a candlestick. Different types of candlestick patterns represent different types of market participants’ attitudes. The candlestick patterns can also reflect the trading patterns since investors are humans only and humans try to act similarly in the same situations.

The Nifty formed a distribution throughout the day near the key Fibonacci level & moved lower towards the end of the session. Overall structure shows that the index is still in short-term consolidation & can trade around 18,700-18,300 over the next few sessions. Markets will react to the outcome of the US Fed meet in early trade on Thursday. A decisive move above 18,750 in Nifty would further fuel the recovery, else consolidation will resume. Meanwhile, traders should maintain their focus on identifying stocks from the sectors trading upbeat. Apart from the index majors, one can selectively choose from the broader indices too, citing the recent improvement in their participation.

The opening and closing prices are lower than the second Doji. The second Doji is formed a little higher than the first candle. The opening price is higher than that of the previous Doji candle. The third Doji candle is formed a little higher than that of the second Doji. The opening and closing prices are higher than the second Doji.

This candle can be characterized by a small body and a wick at the bottom which is twice the size of the body. This candlestick pattern represents extreme bearishness in the market. This candle indicates that the sellers are in control of the stock price throughout the trading session. In this candle, the high is the opening price and the low is the closing price for the session. This candlestick pattern represents extreme bullishness in the market. This candle indicates that the buyers are in control of the stock price throughout the trading session.

A Double Doji candlestick pattern is made up of two Doji candlesticks and represents a significant trend reversal or continuation. A double Doji candlestick pattern is observed near the close of the market trends and has a higher reversal potential than a single Doji. The red line in the picture posted above shows how a Doji star bullish candlestick pattern has been formed which is followed by a long up move in the stock price. Had one initiated a trade in the long side after getting the confirmation from this pattern, one would have been able to gain a huge profit.