Content

The failure-to-file penalty amount will be reduced by the amount you owe for failure to pay penalty for any month that both penalties apply. If you file more than 60 days late, your minimum failure to file penalty will be 100% of your unpaid taxes or $435 . If you are only late to file, meaning you have paid your due tax, then the maximum late filing penalty is applied https://kelleysbookkeeping.com/ at 5%. If you are late to file and pay, then your late filing penalty is reduced by the late payment penalty, resulting in a penalty of 4.5%. If you are only late to pay, meaning you have filed a tax extension or return but did not pay, then you would only face a penalty of 0.5%. These penalties will increase over time, up to a maximum of 25% of your unpaid taxes.

What is the penalty for filing income tax return late?

Payment of Interest

If you do not file income tax returns on or before the due date, you would be required to pay interest at the rate of 1% for every month, or part of a month, on the amount of tax remaining unpaid as per section 234A.

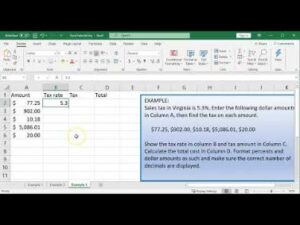

It is possible for a return to be subject to both the late payment penalty and the extension penalty, as explained above. Virginia law provides an automatic extension of 6 months for the filing of individual and fiduciary income tax returns. There is no extension of time granted for payment of taxes due.

Tax Relief and Resolution: 5 Ways to Deal with Tax Debt

If you don’t have a bank account or prepaid card, consider opening an account or getting a prepaid card. Many banks and credit unions offer accounts with low monthly maintenance fees when you have direct deposit or maintain a minimum balance. These accounts may limit the types of fees you can incur and may also offer free access to in-network automated teller machines .

If you were owed a refund for these years, it has gone to the federal government. If you owed taxes in these years, file and pay as soon as possible. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

What if I owe the IRS but can’t pay?

It is not dependent upon continuous physical presence. To request penalty abatement, call the toll-free number on your IRS notice or submit your request in writing using IRS Form 843. To have a penalty removed due to reasonable cause, you will need to send the IRS copies of supporting documentation, such as hospital records, a letter from your doctor, Filing Income Tax Return Late a death certificate or insurance claim reports. If both the failure-to-file and failure-to-pay penalties apply, the IRS reduces your failure-to-file penalty by the amount of the failure-to-pay penalty. This penalty applies when your failure to file or pay is because of negligence or disregard of the rules and regulations but without intent to defraud.

When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.If you already have an account with a bank or credit union, make sure you have your information ready — including the account and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account. (Form F-1065 ) if one or more of its owners is a corporation. In addition, the corporate owner of an LLC classified as a partnership for Florida and federal income tax purposes must file a Florida corporate income/franchise tax return. For a deceased taxpayer, the filing due date is generally the same as the filing date would have been had the person lived until the end of his or her tax year.

Why You Should File Your Past Due Return Now

You are also looking at a late filing penalty of 5% of the unpaid tax per month, plus interest. You’ll likely end up owing a late payment penalty of 0.5% per month, or fraction thereof, until the tax is paid. • If you have a refund coming from the IRS, then there’s no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension.

- You are also looking at a late filing penalty of 5% of the unpaid tax per month, plus interest.

- He leases an apartment in Maryland and works 230 days in Maryland.

- It is possible for a return to be subject to both the late payment penalty and the extension penalty, as explained above.

- The maximum total penalty for failure to file and pay is 47.5% (22.5% late filing and 25% late payment) of the tax.

Having a problem with a financial product or service? We have answers to frequently asked questions and can help you connect with companies if you have a complaint. The Child Tax Credit is worth a maximum of $2,000 per qualifying child. To be eligible for the CTC, you must have earned more than $2,500. A designated family member of a severely-injured service member who is incapable of handling their own affairs. A family member who is managing the affairs of an eligible service member while the service member is deployed.