Content

- Capitalization Example

- Understanding How to Capitalize

- Benefits of Capitalization

- What Are the Differences Between Straight Line, Double-Declining Balance & Units of Production?

- capitalized expenditure

- Expensing vs Capitalizing

- Ways in which Expenses can be Capitalized

- The difference between expensing and capitalizing

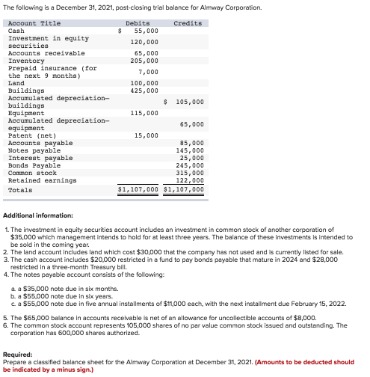

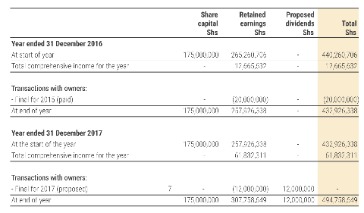

There have been some instances where companies have used capitalizing vs. expensing against the common accounting procedures. While this might influence the short-term profits of the company, it can also do damage to the company’s finances. As we’ll discuss later in the guide, this lack of a set of lists has both advantages and disadvantages to a business.

- To smooth out profits over time, you would capitalize the expense and move a portion of it to the income statement each year of the asset’s life as a depreciation expense.

- A capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation.

- Two sets of software capitalization rules determine whether you expense or capitalize your software.

- Some common long-term assets are computers and other office machines, buildings, vehicles, software, computer code, and copyrights.

After that, software production costs may be capitalized and reported at the lower of either the unamortized cost or the net realizable value. Capitalized costs are amortized based on current and future revenue for each product, with an annual minimum equal to the straight-line amortization over the remaining estimated economic product life. For these purposes, a software product is defined as either a new product or a new initiative that changes the functionality of an existing one. When a cost is capitalized, it is reported in the balance sheet as an asset.

Capitalization Example

We strongly recommend monthly as it’s a true cost of the business and it’s needed to show the true profit or loss each month. Plus a monthly entry avoids a major adjustment at the end of the year just to get a tax return done. A rule of thumb to use when totaling fixed-asset expenditures is to ask whether the components are functionally interdependent – also known as a unit of property. Expense in construction is simply recording the purchase as an expense on the profit and loss statement.

Is it better to capitalize or expense?

To capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. In general, capitalizing expenses is beneficial as companies acquiring new assets with long-term lifespans can amortize or depreciate the costs.

This provision of capitalizing vs expensing is also manipulated by companies and can play a huge role in financial scandals. WorldCom is an example of how such a decision can ultimately lead the company to bankruptcy. This judgment alone can have a huge impact on the company’s profit and hence its stock price. Therefore, the choice between expensing and capitalizing should be made wisely. The value of the asset that will be assigned is either its fair market value or the present value of the lease payments, whichever is less.

Understanding How to Capitalize

Waterfall development had a well-defined up-front phase, during which requirements were developed, the design was produced, and feasibility was established. For those projects that received further approval, the requirements and design milestones often served as phase gates for starting capitalization, as shown in Figure 2. If you’re developing completely new software from the ground up, you’ll need sufficient analysis to determine when this project is technologically feasible. With no precedent, it may be difficult to determine what this metric is. GAAP. The GAAP outlines capitalizing requirements based on the waterfall approach.

Pre-technological feasibility refers to the earlier stages of your software development. When you conduct an analysis of how to create the product and design the software, these will count as expenses. The key to understanding why capitalizing benefits businesses is best explained by the matching principle. The Principle of Matching is the foundation for the widely acceptedaccounting methodused in the United States (U.S. GAAP). In terms of business selling software, this software is an asset to the company.

Benefits of Capitalization

They will go in order, such as conception, analysis, design, construction, etc. Pasquesi Partners shares tips and information through free articles and resource publications on tax planning as well as specific guides for businesses and individuals. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. When expanded it provides a list of search options that will switch the search inputs to match the current selection.

She has conducted in-depth research on social and economic issues and has also revised and edited educational materials for the Greater Richmond area. The use of the word capital to refer to a person’s wealth comes from the Medieval Latin capitale, for «stock, property.» INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. You are a living example of what we read in our historic books that knowledge, education needs to be shared to everyone without expecting any benefit.

Capitalized interest is the cost of borrowing to acquire or construct a long-term asset, which is added to the cost basis of the asset on the balance sheet. There are strict regulatory guidelines and best practices for capitalizing assets and expenses. Most companies have an asset threshold, in which assets valued capitalization vs expense over a certain amount are automatically treated as a capitalized asset. Capitalization is used in corporate accounting to match the timing of cash flows. Profit MarginProfit Margin is a metric that the management, financial analysts, & investors use to measure the profitability of a business relative to its sales.

Conversion to actual costs is handled in the same way as for the preceding example. This low-friction, low-overhead method generally does not create any additional burden on teams other than the need to update estimates to actuals for completed stories. Again, ALM tooling typically supports the recording and automated calculation of such measures.

capitalized expenditure

Decide your de minimus rule – You can set an appropriate level with your accountant and check whether a cost falls under the rule before you count it as an expense. Learn about the guidelines – Check information on capitalizing vs. expensing from sources such as GAAP. Financial ratios – The decision to expense will result in higher operation-efficiency ratios. Stockholders’ equity – The effect on stockholder’s equity will be relatively limited. Nevertheless, expensing companies tend to experience a lower equity at the start. Nonetheless, you want to check with your local accountant, as different countries might have different ways to analyse R&D costs.

What is capitalization versus expensing case?

Expensing is that capitalization is the method of recognizing the cost incurred as an expenditure that is capital in nature or recognizing such expenditure as an asset of the business, whereas expensing refers to the booking of the cost as an expense in the income statement of the business which is deducted from the …