Contents:

ForexPeaceArmy.com has advertising and affiliate relationships with some of the companies mentioned on this site and may be compensated if readers follow links and sign up. We are committed to the fair handling of reviews and posts regardless of such relations. Client money remains segregated from our fundsand will be unaffected in the event of our insolvency. Get insight for your investment strategy with objective news and research from industry leaders like NewsEdge and AutoChartist.

At BrokerChooser, we consider clarity and transparency as core values. BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you . We tested it and collected the options and costs in How to withdraw money on Questrade. Educational materials are found in the ‘Resources’ section on the Questrade website. You can read blog posts on investing, register for on-demand webinars and search for information in the ‘Help & How-to’ section. Finding answers to generic questions using the search function is fairly simple.

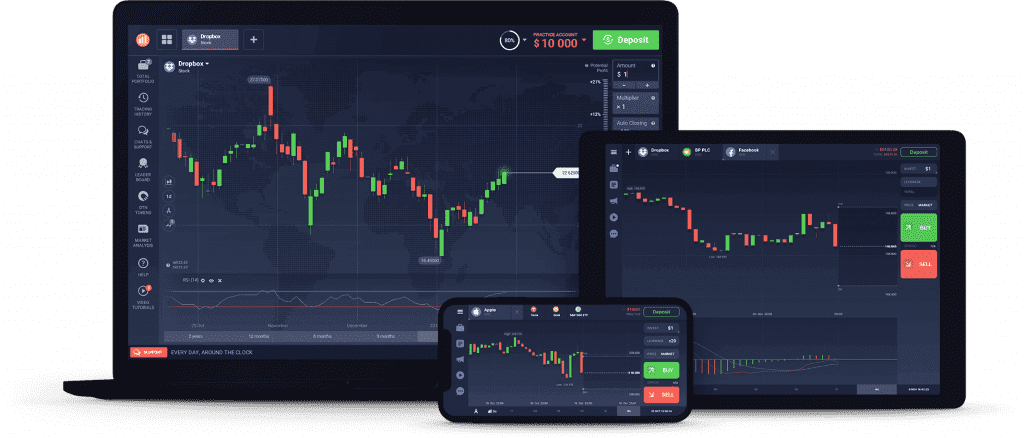

The New Questrade Mobile App works flawlessly on smartphones and tablets and is available in the Apple App Store and Google Play stores. The app is targeted at investors who trade frequently, but it’s handy to have regardless. The power to trade “on the go” means you’ll never miss an investment opportunity. Your portfolio will likely contain a mix of stocks along with less volatile assets like bonds and GICs. Questrade charges a spread that is built into the price of the bond and varies depending on the individual bond. Trading GICs at Questrade is commission-free, but the minimum order is $5,000 .

Questrade is a fit for you if you are a Canadian citizen and resident, and wish to avoid the high fees and restrictions placed on those who hold investments at banks. It offers a lot more flexibility to Canadian investors, including an automated portfolio builder and significantly lower fees. By far the most useful educational tool Questrade offers is thedemo accountfor each of its platforms. Using these, you cansimulate investing and trading, even before depositing funds. This tableshows the mobile trading platforms that are available at Questrade.

While Questrade offers ten deposit and withdrawal options, they are all centered around bank transactions. Depending on the payment or transfer options, transaction times range between one and twenty-five days with fees between $0 and $200. Regrettably, Questrade does not support third-party payment processors and e-wallets, leaving clients with disappointing but suitable options. Electronic fund transfers up to C$50,000 or $25,000 are free of charge. Bank wires in Canadian Dollars face a $20 surcharge, increased to $30 for bank wires in US Dollars and $40 for international ones. Questrade also accepts uncertified cheques for an additional cost of $50 and only in Canadian Dollars or US Dollars.

Our best alternatives to Questrade are:

To have a clear overview of Questrade, let’s start with trading fees. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. First, let’s go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees. Questrade was recognized for its industry-leading performance, its business practices and its sustained growth by receiving the prestigious award. Good support with live chat, email and toll-free number with call-back service.

There is also a high fee for wire withdrawals outside Canada. BrokerChooser gave Questrade a 4.5/5 rating based on analyzing 500+ criteria and testing via opening a live account. Questrade is an excellent online broker for Canadians to consider.

Alongside its mobile app, Questrade offers IQ Web and IQ Edge as its two primary trading platforms. IQ Web is browser-based and IQ Edge is a desktop trading platform available for Windows and MacOS. While the platforms are similar in overall functionality, IQ Edge has a deeper offering of trading tools and customization and is certainly the preferred platform for active traders.

- What you need to keep an eye on are trading fees and non-trading fees.

- The term commission-free attracts scores of new traders who feel the global financial system discriminates against them in favor of professional clients.

- IQ Edge is highly customizable and created for advanced day traders .

- They can be opened as a registered retirement plan , a registered retired education savings plan , a registered retirement income fund as well as other options.

- This page of our website is dedicated to our Questrade review for Canada traders, which aims to tell you everything you need to know about this Canada-based online brokerage.

- In-house portfolio managers maintain all Questwealth portfolios, supported by over 100 agents assisting interested clients.

The service extends to ETF (exchange-traded funds) and SRI portfolios. Questrade created a genuine marketplace for passive investors, and it maintains an excellent infrastructure supporting this sector. The Investment Industry Regulatory Organization of Canada regulates Questrade, which is also a member of the Canadian Investor Protection Fund . It is critical to distinguish that its Robo-Advisory wealth management unit, Questrade Wealth Management Inc. , is not included in either the IIROC or CIPF. This broker additionally offers 100% reimbursement for unauthorized transactions in a statement of its confidence in deployed security technology and protocols.

Questrade Broker Review

Maybe as a result of its simplicity, it offers limited customizability, especially compared to Questrade’s highly customizable desktop trading platform. We tested the bank transfer withdrawal and it took more than 3 business days. Trading on margin basically means that you borrow money from your broker and can purchase more https://forexbroker-listing.com/ shares than you could with just the available cash in your account. You have to pay interest on this borrowed money – the interest rate is called the margin rate. It can account for a significant portion of your trading costs. Questrade charges $0.01 per share for a trade, with a minimum fee of $4.95 and a maximum of $9.95.

Selling ETFs starts from just $0.01 per ETF with a minimum of $4.95 and a maximum cost of $9.95 for regular retail clients. Having a ceiling offers traders cost control, a beneficial tool questrade forex non-existent at most brokers who do not maintain a maximum commission cost. Active traders receive an improved Questrade ETF fees structure that consists of a fixed and variable option.

Questrade App

QWM is a registered Exempt Market Dealer, Investment Fund Manager and Portfolio Manager. QWM is a wholly owned subsidiary of Questrade Financial Group Inc. Questrade offers competitive spreads on Forex & CFD trading with an average typical target spreads on the EUR/USD of 0.8 pips on the Questrade proprietary trading platform. On the Metatrader 4 trading platform spreads are considerably higher on the EUR/USD forex trading pair, with an average spreads of 1.7 pips over the same period.

There are over 100 forex currency pairs available, and a separate account for CFDs. Questrade Trading is the broker’s proprietary trading platform, offering opportunities for just about everyone to trade, manage accounts, research stocks and check on performance. Keep track of all your account balances as you monitor, research and trade your investments. The platform even includes an integrated Learning Mode, enabling you to finesse your trading skills as you go. Ever since Alexander got his first stock savings account, he’s also taken a keen interest in the financial markets. Now a full time writer and contributor to TradersBest.com, he uses his experience in the world of finance on a range of different topics, from investment strategies to reviews of new brokers.

Hans Daniel Jasperson has over a decade of experience in public policy research, with an emphasis on workforce development, education, and economic justice. Congress, federal agencies, and policymakers in several states. Check out the current account balance requirements at Questrade in our What is the minimum account balance at Questrade article. A glance at actual costs and whether Questrade is really free. Is Questrade legit features all the key aspects you need to look at to see if a broker is safe and legit.

Deposit and withdrawal

Questrade charges $0.01 per share with a minimum fee of $4.95 and a maximum of $9.95. When you trade with ETFs, you will be charged only when you sell. A brokerage account allows an investor to deposit funds with a licensed brokerage firm and then buy, hold, and sell a wide variety of investment securities. Questrade’s web-based platform is mobile-enabled, and the display adjusts to whatever device you are using. Watchlists created on the web platform are also accessible on the mobile platform.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

With Questrade’s webinars, users can improve their investing skills with on-demand webinars for beginner to advanced investors and traders. These on-demand webinars include such topical themes as improving investor confidence, introduction to index investing, dividend investing, and ETF investment strategies. Questrade offers excellent customer support through a live chat option, email, or a toll-free number.

Questrade Cost and Fees, Commissions and Spreads

Information is available on various topics, such as order types, how to install IQ Edge, and funding. The live chat service is very fast, they provide information almost immediately. When starting a chat you have to answer a few questions first, which is a minor inconvenience.

The primary distinction is between self-directed investors, active traders, and Questwealth portfolios. Equity trading commences from $0.01 per share with a minimum commission of $4.95 up to a maximum of $9.95. Management fees for Questwealth portfolios are 0.25% of the portfolio size, reduced to 0.20% above $100,000.